Howdy Business Preneurs!

The Treasury opens the PPP (Paycheck Protection Program) effective 12:01 am tomorrow.

I have attached multiple documents including a checklist to assist with the PROACTIVE planning for your meeting (Virtual process usually) with your banker. (SOME EIDL Documents are attached for your convenience as well)

You should start, if you haven’t already done so, by reaching out to YOUR CURRENT BANK! They will be the fastest way to get approval as they will already have historical information from you!

I have personally spoken with 6 banks so far. Only 3 will be ready to take applications tomorrow but make your appointments for asap with them to get things going. None of the banks that I spoke with will take businesses that do not have a current business or personal banking relationship with them at this time.

Here is the checklist cumulated for all of them (Also attached for easy printing). Very little variance as the Department of the Treasury and the SBA have dictated the verification points, and YES, THEY WILL VERIFY DATA!

Many of the documents on this checklist will need to be from your payroll provider, your bookkeeper and or your accountant. Please be patient with all of them as well as you are probably not the first in line at this point to ask for these things.

PLEASE DO NOT PROCRASTINATE IN GETTING THESE THINGS TOGETHER. YOU DO NOT WANT TO SLOW DOWN THE PROCESS OF GETTING HELP HERE FOR YOU AND YOUR STAFF.

SBA Loan Programs

PPP / EIDL Check Lists

BE Prepared with these documents to expedite the process!!!

Not all of them may be necessary but you don’t want to delay funding!

Other Documents may be needed by bank but this should cover most.

PPP

o PPP Application – SBA form 2483

o Payroll Monthly Average including taxes and insurance benefits monthly broken down by wages, taxes, retirement (401k), insurance, other

o Itemized 941s for last four quarters filed and 940 for prior year

o Payroll Summary with corresponding bank statement for Jan, 2019 – if not available, paystubs for approximately 2-15-20 with corresponding bank statement

EIDL

o EIDL Application – Online and Hard Copy

Both LOANS

o Owner’s Driver’s licenses

o Profit and Loss Statement for 2019

o Balance Sheet ending 12-31-19

o Personal Financial Statement

o IRS Form 4506-T

o Liability Statement

o Additional Filing requirements document – OMB #3245-0017

o Last Tax Filing for the Business

o Last Tax filing for the owner

o Statement of How COVID-19 has affected your business (See below) including what the loan will be used for. (PPP can only be used for Payroll, Payroll related costs, rent, utilities and operating costs)

o Articles of Incorporation & Corporate Operating Agreement (If new to the bank)

REMEMBER – THESE LOANS ARE ONLY MADE FOR THOSE WITH AN ECONOMIC IMPACT WHICH YOU WILL NEED TO ATTEST TO. BELOW IS SOME VERBIAGE FOR THE STATEMENT OF WHY THIS APPLIES TO YOU. PLEASE MAKE IT YOUR OWN BUT THEY DO NOT NEED NOR WANT A LONG DRAWN OUT STORY.

———————————————————————————————————————————————————————————————————————————

To Whom it may concern,

My business, ______________________, EIN _______________ has been impacted by the COVID-19 virus because we are not able to operate our normal business hours of operation and our customer base has been encouraged not to leave home.

The loan will help us to cover payroll costs, rent and utilities during this downturn in our revenues.

We appreciate all support.

Thank you,

Owner

Business Name

——————————————————————————————————————————————————————————————————————————————————————–

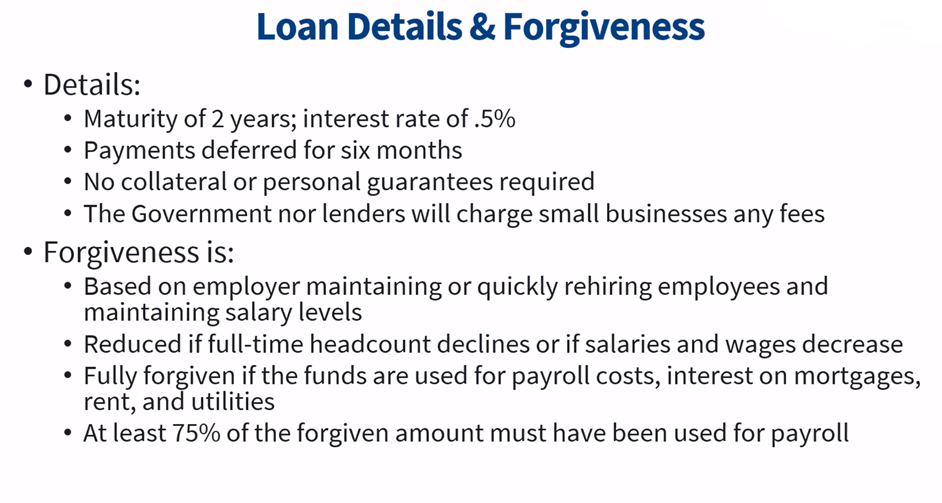

FAQs are in the SBA site and here is a slide from the Houston SBA presentation from yesterday for a quick peak at a few common FAQs.

One other very common question is do 1099 contractors count towards payroll or can their pay be included in the 75%.

The answer is a clear no, unfortunately.

The reason is that 1099s (Self employed, sole props and partnerships) can apply themselves for relief starting now with EIDL then on the 10th for PPP.

We will be cumulating supporting data for our clients that want assistance so please let us know what you need and/or if you want to schedule a time to get your data together.

We are praying for all of your safety as well as financial sustainability through these unprecedented times!

Be well!

David Mosberg

813-997-9756

Helpful Documents:

Borrower Paycheck Protection Program Application

EIDL Additional Filing Requirements

Form 413 – Personal Financial Statement